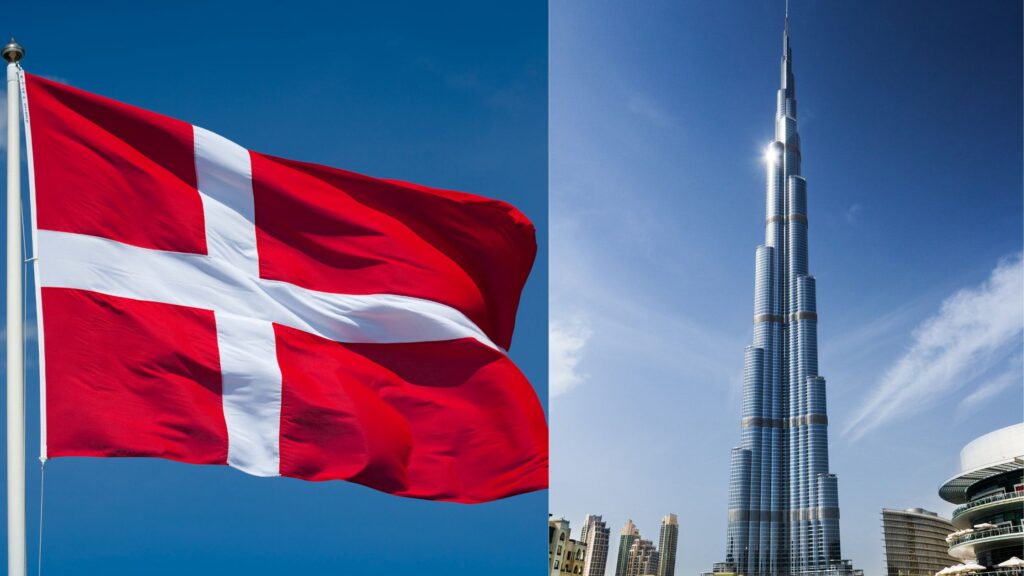

Dubai has become a global hub for entrepreneurs and international investors — and Danish citizens are increasingly drawn to its tax-friendly environment, world-class infrastructure, and ease of doing business. One of the most popular and strategic ways to set up a company in the UAE is through a Free Zone. In this blog, we’ll explore how Danish citizens can start a Free Zone business in Dubai, step-by-step, through MAF Businessmen Services, your trusted local partner.

What Is a Free Zone in Dubai?

A Free Zone is a designated area where foreign investors can fully own their businesses, enjoy 100% profit repatriation, and benefit from zero personal and corporate taxes. Dubai has over 30 Free Zones, each catering to specific industries like tech, media, logistics, finance, and healthcare.

Why Danish Entrepreneurs Choose Dubai Free Zones

Danish citizens are known for their innovation, global outlook, and business acumen. Dubai’s Free Zones offer:

- 100% foreign ownership

- No income or corporate tax

- No import/export duties within Free Zones

- Full repatriation of capital and profits

- State-of-the-art infrastructure

- Quick business setup process (3–7 days)

These benefits make it an ideal choice for Danish startups, SMEs, and established companies looking to expand globally.

Can a Danish Citizen Open a Business in a Dubai Free Zone?

Yes! Danish citizens are fully eligible to open a Free Zone company in Dubai. There are no restrictions on nationality for most business activities in Free Zones. Whether you are a solo entrepreneur, a tech startup founder, or an investor, Dubai welcomes foreign business owners from Denmark.

Steps to Start a Free Zone Business in Dubai (for Danish Citizens)

Here’s a simplified breakdown of the process when working with MAF Businessmen Services:

1. Choose the Right Free Zone

Not all Free Zones are the same. Some are industry-specific (e.g., Dubai Internet City for IT companies), while others are more general-purpose. MAF Businessmen Services helps Danish entrepreneurs select the most cost-effective and relevant Free Zone based on your business model.

2. Select Your Business Activity

You must choose from a list of approved business activities (trading, consultancy, e-commerce, manufacturing, etc.). The business activity determines the type of license you’ll need.

Popular licenses for Danish entrepreneurs include:

- Professional License

- Commercial License

- Industrial License

- E-commerce License

3. Submit Documents

You’ll typically need to provide:

- Copy of your passport (valid for at least 6 months)

- Passport-sized photos (white background)

- Business plan (for some Free Zones)

- Application form

MAF Businessmen Services will handle all document preparation and submission on your behalf.

4. Get Approvals & Business License

Once your documents are approved, the Free Zone authority will issue your business license. This can take as little as 3–7 working days with expert assistance.

5. Open a UAE Business Bank Account

After obtaining your license, you can open a business bank account in Dubai. MAF works with leading banks in the UAE to ensure a smooth banking setup for Danish citizens.

6. Apply for Visa (Optional)

Free Zone businesses can sponsor visas for owners and employees. You may apply for:

- Investor visa (2 or 3 years)

- Employee visa

- Dependent visa (for family)

Cost of Setting Up a Free Zone Business in Dubai

The cost depends on several factors:

- Free Zone chosen

- Number of shareholders

- Type of license

- Number of visas required

- Office space requirement (virtual, flexi-desk, or full office)

Why Choose MAF Businessmen Services?

MAF Businessmen Services is a UAE-based, government-registered service center specializing in business formation for international investors. We provide end-to-end support for Danish citizens looking to start or expand their business in Dubai.

- Business License Processing

- Free Zone Selection & Consulting

- Document Clearance

- Visa & PRO Services

- Office Space Solutions

- Bank Account Assistance

- Ongoing Business Support

With years of experience and a deep understanding of Free Zone regulations, MAF ensures your company is set up legally, efficiently, and affordably.

Starting a Free Zone business in Dubai is one of the smartest moves a Danish entrepreneur can make in today’s global market. With zero tax, full ownership, and business-friendly policies, Dubai continues to attract investors from Denmark and beyond.

Partnering with MAF Businessmen Services ensures you get expert guidance every step of the way — from Free Zone selection to license issuance and beyond.

Ready to start your business in Dubai?

Contact us today: [email protected]

Your gateway from Copenhagen to Dubai begins here. 🌍